Why You Should Act

Before the Losses Climb

This is one of the quickest recoveries on record

Australian Housing Market Bounces Back in Early 2025: Key Drivers and Regional Insights

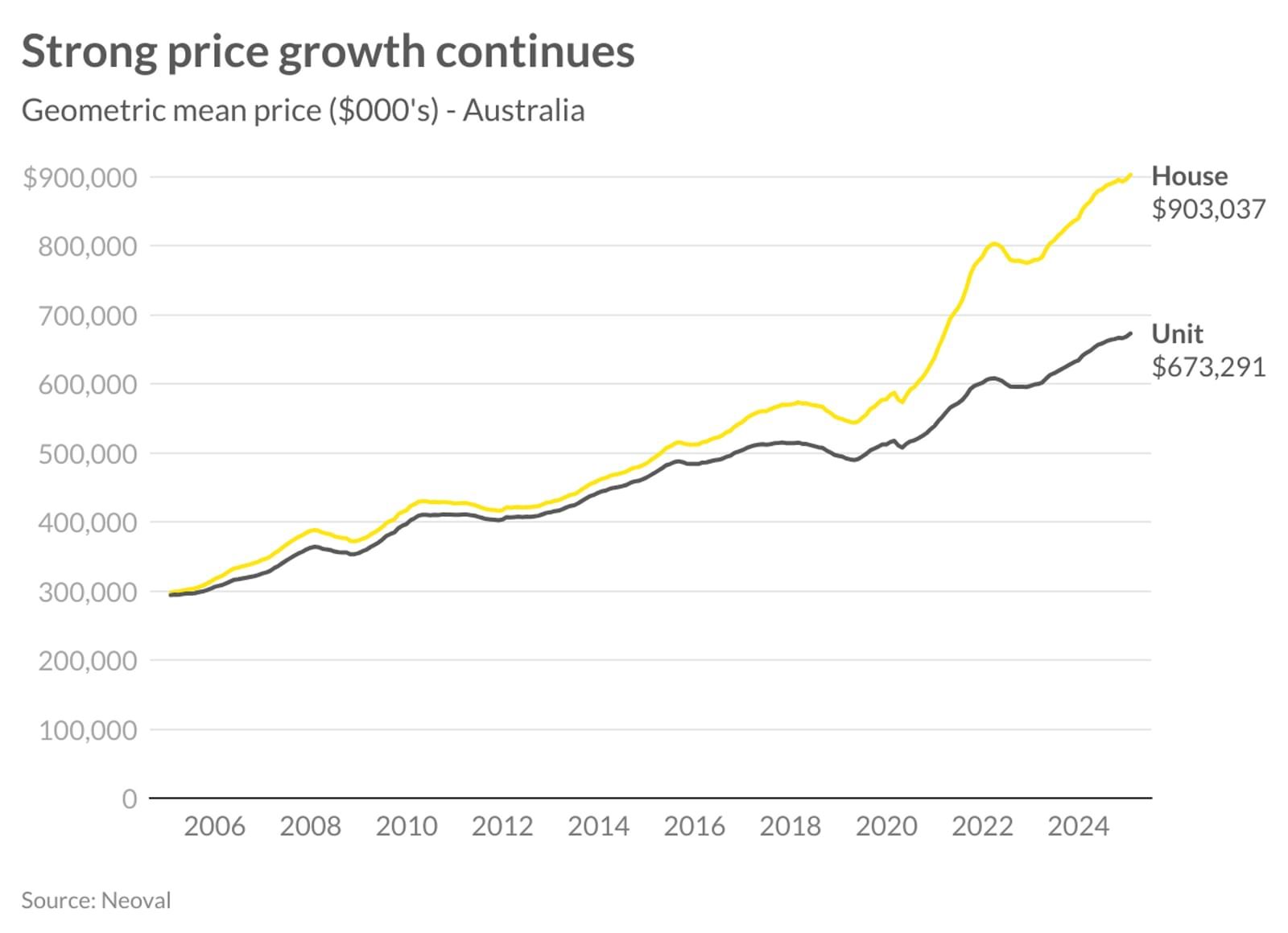

The Australian housing market has bounced back in January 2025, after a brief dip in December 2024. This is one of the quickest recoveries on record and has been driven by expectations of rate cuts and a seasonal decline in new listings according to Nerida Conisbee, Chief Economist at Ray White.

Macroeconomic and Structural Drivers

Here are the key drivers:

Monetary Policy Expectations: Market is expecting rate cuts from the Reserve Bank of Australia (RBA) and that’s instilling buyer confidence and more transactions. Supply Constraints: Australia has a structural undersupply of housing, delayed projects, labor shortages and high building costs are all putting upwards pressure on prices. Seasonal Variability: The market slows down during December and early January so there are less listings and that’s making the competition among buyers fiercer and prices up. Western Australia: A Regional Perspective

WA has followed the national trend but has its own regional dynamics:

Strong Fundamentals: WA’s property market benefits from sustained demand from the mining sector (iron ore and lithium) and the state’s economy has been outperforming national averages in recent quarters which is supporting employment growth and housing demand. Population Growth and Migration Trends: Net interstate and overseas migration to WA has surged especially due to the affordability advantage over the eastern states. Perth is a attractive to buyers who seek affordability and good lifestyle. Low Housing Stock: The rental vacancy rate in Perth is critically low (sub 1% in late 2024) which is showing the supply constraints. This is translating to strong growth in both rental and sales markets. Regional Disparities:

While Perth is leading the WA recovery, regional areas like Bunbury and Geraldton are also seeing high demand due to affordability pressures in the metro area. Mining towns like Karratha and Port Hedland are volatile but high rental yields.With rate cuts expected in 2025, seller friendly conditions may emerge as borrowing capacity increases. But long term structural undersupply will continue to drive price growth with occasional corrections being the new normal for the Australian property market.

WA is looking at further price growth due to strong fundamentals and ongoing supply shortage. Policy interventions such as incentives for new home building and infrastructure spend may impact housing affordability and supply in the region.